Blog

Bookkeeping and Landlords: 8 Tips to Keep Organized

Feb 20, 2023

Bookkeeping is rarely cited as a favorite activity but it is a necessity for every business. A reliable and accurate record of transactions is an indispensable tool for strategic decision making and essential for tax purposes. Keeping ledgers organized can be problematic but we have eight tips to keep you on track.

1. Set Up Separate Bank Accounts

If you’re a landlord it will be much more difficult for you to stay organized if you attempt to operate your business from your personal bank account. Setting up a separate checking and savings account will prevent your business income and expenses from getting lost among your private transactions. This is the easiest way to stay organized and simplify your bookkeeping.

Some landlords go so far as to have a separate bank account for each property. This is probably unnecessary if you manage a few single family homes. Multi-family properties will have a lot more transactions and can benefit from a dedicated bank account. For robust portfolios of single family properties, grouping them by geographic location and allocating a separate bank account for each area can declutter your records.

If you are a property manager you must have a separate business account or you risk tax and liability issues for yourself and for your business. It is illegal to merge your own private funds with that of a client’s so you must keep their assets separate from yours. Not only should you have a separate business bank account, you should also be familiar with handling trust accounts.

2. Decide How To Record Transactions

It is imperative that you have an accurate and consistent method of recording all of your business transactions. You will need to account for every bit of income and each expense related to any of the properties you are managing. Thankfully this task doesn’t have to be difficult if you have the right tools for your business needs.

For those who are just starting out it might be enough to simply file away all receipts and invoices until the end of the year. If that begins to get overwhelming, switching to a spreadsheet system can be effective at keeping things organized. For small investors accounting software can be equally good at tracking your income and expenses.

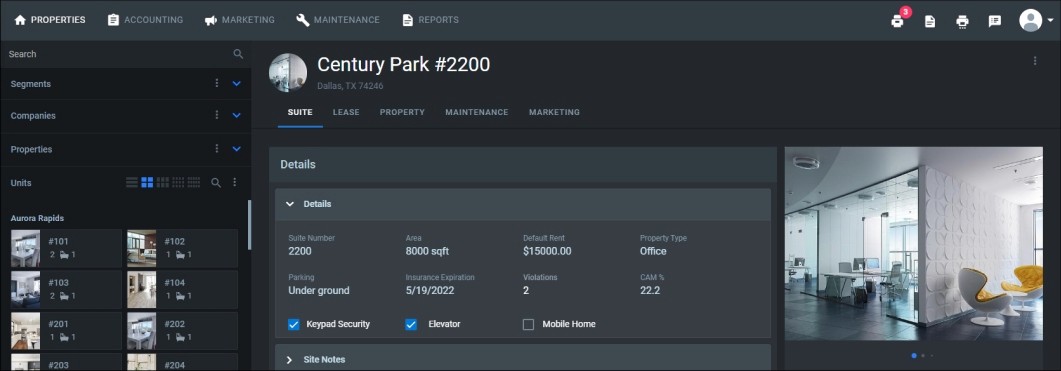

For large scale investors with robust portfolios the best option is to invest in dedicated property management software. This is also true for property managers handling multiple clients. Built specifically for handling the complexities of the business these programs have all the tools that you need to keep organized.

3. Have A System To Stay Consistent

However and whenever you choose to record your transactions, it is a good practice to have a consistent system for accomplishing this task. Many people view data entry as a tedious task but it is a critical component of accounting and bookkeeping. This is why you need a system to stay on top of the job.

Establish exactly what data you will be capturing. The basics such as amount and date will of course be there but you also need to link your records to tenants and properties. You will also need to establish general ledger accounts to place your transactions into.

Once you have the what ironed out you need to determine the who and the when. Will you be doing the data entry yourself or is someone else responsible for it? How often will the data entry be done? Don’t let your receipts pile up until things get out of control. Have a plan.

4. Deploy Automated Collections Activities

One thing that brings disorganization to your books are accounts in arrears. It’s unlikely that you’ll ever fully eliminate late payments but you can improve the look of your ledgers without adding to your workload by utilizing automated reminders. Create text or email alerts that get sent to tenants when their bill is past due. You can even be proactive and send reminders of an upcoming bill.

5. Accept Electronic Payments

Another way to reduce the number of delinquent accounts on your records is to make it easier for tenants to pay their bills on time. A good way to accomplish this is to accept electronic payments online. Allowing tenants to pay their rent by credit card or ACH eliminates the hassle and allows you to get your rent payments sooner.

Streamlining your accounts receivable processes can give you better control over your money and help you stay organized. Depending on the software that you use, accepting electronic payments might even help you cut down on data entry. With the right program your electronic payments can automatically be applied to the appropriate accounts.

6. Have An Accounts Reconciliation Plan

It’s great to keep solid accounting records but if the numbers don’t reflect real life then your bookkeeping won’t be very useful. Reconciling your accounts simply means verifying that your records and your bank statement are in agreement. Doing a regular reconciliation is a crucial step and is considered standard practice.

For most businesses, accounting reconciliation is a monthly activity. You should plan for this in your schedule and set aside enough undisturbed time to complete the process. The more complex your property portfolio, and the more unorganized your books are, the more time you will need to reconcile your records.

7. Make Use Of Your Data

Keeping your books organized takes some work and commitment but it’s well worth the effort. Not only is it a necessity for tax purposes, it also gives you valuable data that can help you grow your business. Making regular use of the data that your business generates will help you stay better organized. If you don’t use it you won’t see the need to track it.

It’s a good practice to review your business transactions at the end of each day. Financial statements should be studied on a monthly basis. Evaluate how your business is doing by comparing income and expenses month to month as well as year to year.

8. Use Tools Designed For Property Management

The best way to keep your business organized is to use property management software. While there are many ways to manage properties only industry specific software can consolidate all of your business activities in one place. Keeping your collections, payments, financial statements, as well as tenant and property files in one program allows you to control and manipulate your data to a greater extent.

Making use of property management software allows different parts of your business to have better cross department functionality. This can greatly reduce data entry and eliminate the human errors that come with it. Property management software can keep you organized while reducing workload.

Property Matrix is state of the art software designed specifically for property management. With powerful features to boost your efficiency and keep you organized, Property Matrix can turn a bookkeeping nightmare into a dream. Work smarter with the right tools in your hands.