Blog

What Every Commercial Property Lease Agreement Should Include in 2022

Sep 12, 2022

Commercial properties, their landlords, and their tenants have unique requirements. It’s important for the commercial property lease agreement to be clear and specific. This will help prevent confusion as well as subsequent disagreement.

While some aspects of a commercial property lease agreement may resemble its residential counterpart, there are some key differences and considerations to be made. Keep reading for our top 10 points that every commercial property lease agreement should include.

1. Parties To The Lease

It is important to name the landlord and tenant at the very beginning of the lease. These two parties may be referred to as the lessor and lessee. It is imperative that the names are displayed on the lease correctly to avoid potential problems down the road. Take extra care with details such as designators like LLC, LP, or Inc.

The tenant listed on the lease is liable for payment of rent, any damages to the property, and possibly obligations as outlined by local laws. If the tenant has provided their own name, verify that this is what they want instead of the business name. If their own name is on the lease they may end up being personally liable if something goes wrong.

2. Premises Clause

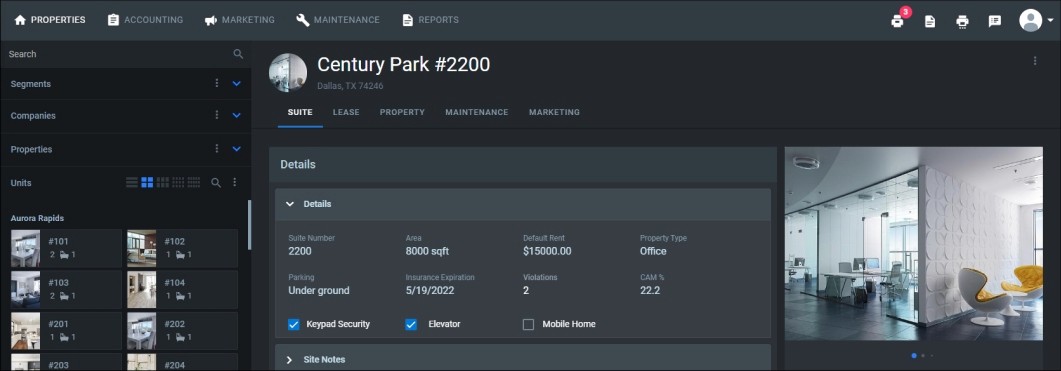

Once the relevant parties have been listed correctly, it’s time to define the rental premises. Start with the basics such as the street address and unit number if applicable. Include details such as square footage and basic amenities.

For some properties this information will suffice but other spaces will require further details. If there are shared areas such as parking, elevators, a lobby, and more it will be necessary to define who has access and use of which space. It’s important to clearly outline who will be using what so that all tenants know what to expect. This can go a long way to preventing friction.

3. Rent Payment Details

After the who and the where have been clearly identified, it’s time to move on to the payment details. The commercial property lease agreement must state the amount of rent to be paid each month. It’s also important to include information such as when the rent is due, acceptable methods of payment, and the consequences of late or missing payments.

4. Term Clause

The term clause outlines the length of the lease. Every commercial property lease agreement should include the starting date of the lease along with the due date for the first payment. The lease agreement should also state when it expires.

It’s a good idea to include information for what happens once the lease is up. Will there be a possibility of renewal? Outline what steps the tenant needs to take to ensure that they can continue renting the premises without interruption. There should also be a section on breaking the lease early and what penalties the tenant may face for doing so.

5. Use Clause

Unlike residential properties, commercial spaces can be used in a variety of ways. It’s wise to include a use clause which stipulates how the property may be used and which activities are prohibited. A commercial property lease agreement might state that the property may be used for retail, manufacturing, office space, or other purposes.

Make certain any uses which might not be in accordance with legal considerations are clearly prohibited. If there are safety considerations in using the property, this would be the place to include information about liabilities. It’s important to cover all restrictions but the lease should not place unreasonable expectations on the tenant.

6. Security Deposit

It is a common practice for landlords to hold a security deposit in case of property damage that may have to be repaired. The lease should outline the amount required as a security deposit and describe situations in which the security deposit may be used. It should also explain how the deposit will be tracked.

Some commercial property landlords prefer a letter of credit in place of a security deposit. This is a document issued by a bank. The bank will set aside the agreed amount and hold it for use by the landlord in the event that the tenant fails to meet obligations as per the lease agreement.

7. Alterations And Improvements

Commercial tenants may need to make substantial alterations to a property in order to make it suitable for the operation of their business. The lease needs to be very clear in outlining what types of alterations the tenant is permitted to make. It should also explain exactly what is not allowed.

A commercial property lease agreement needs to specify who is responsible for the costs of improvements as well as any issues caused as a result of any alterations. In some cases it may be a good idea to define what state the property needs to be returned to when the tenant leaves.

8. Flexibility Clause

In some cases a commercial property lease agreement may include a flexibility clause. This section deals with the ability to sublet the property. The landlord’s rules for subletting should be clearly defined.

9. Utilities And Maintenance Clause

Any commercial lease should outline who is responsible for paying the utilities as well as the costs of keeping the property maintained. For properties with multiple commercial tenants this clause can get fairly detailed. It should include what utilities and maintenance costs cover and how they will be calculated and divided among tenants.

This is a good opportunity to address code compliance. Maintenance issues which fall under local laws should be outlined. Tenants need to know that it is their responsibility to comply with all codes pertaining to the property.

Unlike a residential lease, commercial leases often have a rate escalation clause. This is a provision for unexpected increases to building costs. It includes common area maintenance, taxes, and operating expenses.

10. Insurance Clause

Many commercial landlords require tenants to have insurance. The lease should define the bare minimum insurance that the landlord requires. This may include property and liability, rental interruption insurance, leasehold insurance, or others.

Collect signatures, store lease agreements, retrieve your documents with ease, and set automatic reminders for important dates. Property Matrix makes managing your leases easy to manage.